At Heuritech, we trained our AI to recognize logos from 17 key sneaker brands and analyzed their market share based on social media visibility. So, what does the data reveal about the current sportswear landscape?

Does the sneaker market have a new contender?

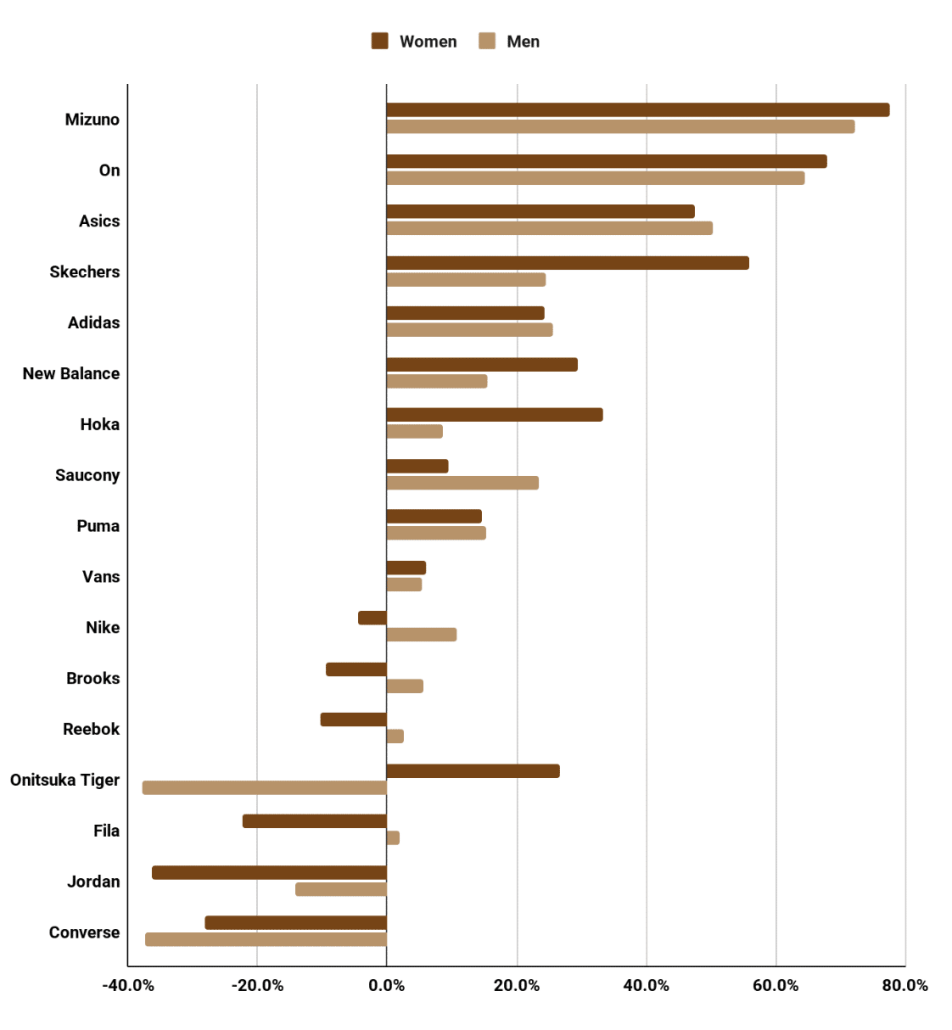

For years, the sneaker market has been ruled by a few major players, but the tide is turning. Enter Mizuno, the latest challenger brand making an impressive splash. In February 2025, the Japanese brand’s visibility in Europe skyrocketed by 75% compared to the previous year, making it the fastest-growing sneaker brand in terms of social media presence. This surge has propelled Mizuno ahead of 2024’s leader, On Running, which still saw strong growth at 66%. While On Running holds a slight edge in market share at 1.4%, Mizuno is rapidly closing the gap, finishing 2024 with 1.1% and an impressive 13% compound annual growth rate (CAGR). In the past month alone, Mizuno added another 0.1 percentage points, while On’s growth stalled—signaling a possible shift in the balance of power.

Social media visibility change – February 2025 vs 2024 – Europe

Source: Data collected by Heuritech

The resurgence of Japanese sneaker brands

Mizuno’s rise is part of a broader cultural moment, as Japanese sneaker brands experience a renaissance. Driven by a combination of shifting consumer preferences and a surge in cultural momentum, brands like Asics and Onitsuka Tiger are gaining serious traction. Asics, Japan’s largest sportswear label, was the third fastest-growing brand last month, seeing a near 50% spike in visibility. Meanwhile, Onitsuka Tiger saw a 27% jump, particularly resonating with female consumers drawn to its nostalgic, retro-inspired aesthetic.

Off the back of increased visibility, Asics is steadily climbing in market share, ending 2024 with 4.8%—an increase of 0.6 percentage points from Q1. While Onitsuka Tiger continues to capture the hearts of trendsetters and niche fashion fans, Asics is positioning itself as a serious player in the global market. Meanwhile, New Balance, which currently holds a solid 10.8% market share in Europe, remains firmly in third place. But with Japan’s economy showing signs of recovery, could Asics be the next contender to challenge the American heritage brand for supremacy?

Challenger sneaker brands in Europe – market share

Source: Data collected by Heuritech

The view from the top

At the top of the market, Nike continues to dominate, with a commanding 40% market share in 2024. Adidas, still in second place with 28%, gained 1 percentage point over the past year. But the real story lies in the momentum shift. Adidas’ visibility growth in February 2025 was a staggering eight times higher than Nike’s, confirming that consumer attention is rapidly shifting toward the German brand.

Top 5 sneaker brands in Europe – market share

Source: Data collected by Heuritech

Adidas has been particularly strong among female consumers, leading Nike in women’s market share with 33% versus 28% at the close of 2024. But the dynamics are changing beyond just women’s sneakers. Among male consumers, Adidas’ visibility growth surged to 26% last month, while Nike’s lagged behind at just 11%. If this trend continues, Nike will have more to worry about than simply holding on to its lead—it will soon face an urgent battle to keep pace with its rival, as Adidas positions itself to potentially overtake Nike at the top.

A sneaker market reignited in 2025 & predictions for 2026

After the peak of sneaker culture in the late 2010s, the sportswear market has cooled somewhat. But with fresh challengers gaining momentum and the battle for the top spot between Adidas and Nike intensifying, the industry is heating up once again. Can Mizuno capitalize on its recent surge? Will other brands – hint: Skechers – follow Mizuno and On into the “challenger basket”? And is Nike’s reign at risk?

Mizuno finished the year of 2025 as the fastest-growing sneaker brand worldwide, with +30% growth in social media visibility year over year. This acceleration was driven by strong engagement among female consumers in Japan, Europe, and Brazil. While Mizuno’s visibility continued to rise, leadership in the women’s segment shifted. Adidas ended the year as the most worn sneaker brand by female consumers globally, overtaking Nike for the top spot with a 28.2% market share. In the men’s segment, Nike remained the global leader with a 38% market share. Competitive pressure intensified over the year, as Adidas recorded the largest market share increase across all tracked brands, gaining +1.5pp and closing the gap to Nike by 4pp. The United States continues to be Nike’s strongest market, where the brand holds a 42% market share across genders. Pressure is mounting here as well: while Nike’s visibility remained flat in 2025 versus 2024, New Balance grew by 20%, narrowing its market share gap with Nike by 2pp.

Challenger brands such as Mizuno, On, and Asics continue to lead growth metrics, while the battle for global leadership tightens between Adidas and Nike. With momentum shifting across regions and segments, one question remains: who will end 2026 as the global sneaker market leader?

As 2026 unfolds, sneaker brands will need to stay ahead of rapidly shifting trends. At Heuritech, our advanced computer vision technology tracks brand visibility and market movements in real time, helping brands navigate this fast-changing landscape. One thing is clear—the competition has never been fiercer. Are the brands ready to keep up?