China’s burgeoning fashion market: Trends and consumers

China has long been in the shadows of the global fashion industry, but now, new trends, movements, and designers are bringing this booming market into the light.

The evolution of Chinese fashion

From imperial traditions to global runways, Chinese fashion has been a dynamic narrative of cultural transformation. Heuritech's analysis reveals a fascinating journey of style, innovation, and identity.

In the early 20th century, fashion began breaking away from Qing Dynasty conventions. The 1920s and 1930s saw the qipao (cheongsam) emerge as a revolutionary garment - initially modest, then dramatically evolving into form-fitting dresses that blended Eastern silhouettes with Western influences.

The Cultural Revolution dramatically reset fashion's trajectory. Utilitarian clothing replaced individual expression, with simple, uniform styles dominating. Yet, this period of suppression ultimately fueled a more explosive fashion renaissance.

By the 1980s and 1990s, Chinese fashion underwent a metamorphosis. Western influences collided with traditional elements, creating a unique aesthetic. Streetwear exploded, with sneakers and hoodies becoming symbols of urban identity. Domestic brands began reclaiming cultural pride, transforming "Made in China" from a manufacturing label to a design statement.

Today's Chinese fashion is a bold fusion of heritage and innovation. Young designers are reimagining traditional elements - mandarin collars, cheongsam buttons, intricate embroideries - through a contemporary lens. The "new Chinese style" emerges as a global language, speaking to both cultural roots and future-forward creativity.

Heuritech's data reveals this evolution isn't just stylistic - it's a profound cultural conversation. From the qipao's transformation to streetwear's rise, each trend tells a story of China's complex, vibrant identity.

The salience of Chinese fashion

There have never been more eyes on China’s fashion market than there are in 2025. The past few years have witnessed the rise of domestic designers, trends, influencers, and social channels at an unprecedented pace, particularly given the digital transformation that has reshaped the industry. This success is not a mere coincidence but the culmination of China’s uphill journey toward global fashion influence.

The attention that non-Chinese brands and audiences are affording their Chinese counterparts today is unlike anything seen even five years ago. Where once a slot at a European Fashion Week was the best shot at international recognition, designers now find equal or greater prestige in Shanghai and Beijing. For instance, designer Samuel Guì Lang made headlines when he prioritized Shanghai Fashion Week over London. Why? While Covid-19 had a part to play, in Yang’s words it was more than that: “Our team has witnessed the rise of the market in China and how Chinese consumers are becoming increasingly interested in independent designers with local traits. So at this point, Shanghai Fashion Week has become indispensable for our brand, our creative ideas and our target audience.” This event marked a turning point in the industry's global shift

While it may seem so from the outside looking in, today’s salience of the Chinese fashion market didn’t happen overnight. A long history of traditional culture, evolving consumer values, new technological innovations, and a melding of Western markets with China’s own are just the outline of the country’s rich state of fashion today. Behind every great market is a story, and this one began many years ago.

China's rise to fashion

China’s love of fashion is nothing new: both abroad and at home, the world’s leading high street brands owe much of their revenue to their Chinese clientele. But this association we so commonly make is more than just expensive taste, it is a marker of the country’s unprecedented economic and social development. In the 1990s, luxury brands were inaccessible for a large portion of the population, while today, Chinese consumers can be thanked for nearly half of all luxury retail sales globally. China is also currently the second largest apparel market in the world, taking up 18.4% of the total market worth of $1,773 billion USD.

Evidently, these numbers are still in large part due to the elite, as they are in most countries. But more and more, younger and middle-class Chinese consumers are putting their yuan into luxury fashion, too, and they aren’t stopping there. Domestic designers are changing the status quo, turning the tables from purchasing to creating. One need only look at China’s three major cities–Shanghai, Beijing, and Hong Kong–to get a clue of the hotbed of creative expression now permeating the industry.

And with the multitude of changes happening all around them in fashion, technology, and society, consumers are the ones rewriting the script for brands, rather than the other way around.

New values borne of idealism are being concretised through fashion

Social media has become a platform for interconnectedness

Shopping has rapidly evolved over the last decade

New-age values of China's youngest

To understand the state of fashion in China today, one must first understand the mindset of the Chinese consumer feeding its evolution. Younger Chinese consumers are much more daring than previous generations when it comes to their fashion choices, notably because they are a demographic that is highly educated, well-travelled, and more fiscally secure.

Genderless fashion for the new consumer

Unlike those of decades past, the Chinese consumer is the decider of its own fashion fate. Genderless fashion is one movement that has taken the streets and runways by storm: Taobao’s top fashion keyword has been mengmei style, meaning cross-gender style or genderless fashion. This movement can be chalked up to Chinese superstar Wan Qian, who has become the de facto “face of mengmei style,” largely thanks to her signature style of oversized men’s suits.

Chinese sports commentary platform Hupu even conducted a survey titled “What Type of Girl Are You Most Likely To Date?” and “The Wan Qian type of girl” took first place with 44.9% of the votes. This trend speaks volumes to the societal development among younger Chinese consumers who aren’t afraid to push boundaries and blur lines.

Chinese sports commentary platform Hupu even conducted a survey titled “What Type of Girl Are You Most Likely To Date?” and the “The Wan Qian type of girl” took first place with 44.9% of the votes. This trend speaks volumes to the societal development among younger Chinese consumers who aren’t afraid to push boundaries and blur lines.

Additionally, Taobao’s reporting found that:

- Women’s searches for oversized blazers were up 317%

- Men’s searches for lace were up 119%

- Men's searches for sheer were up 107%

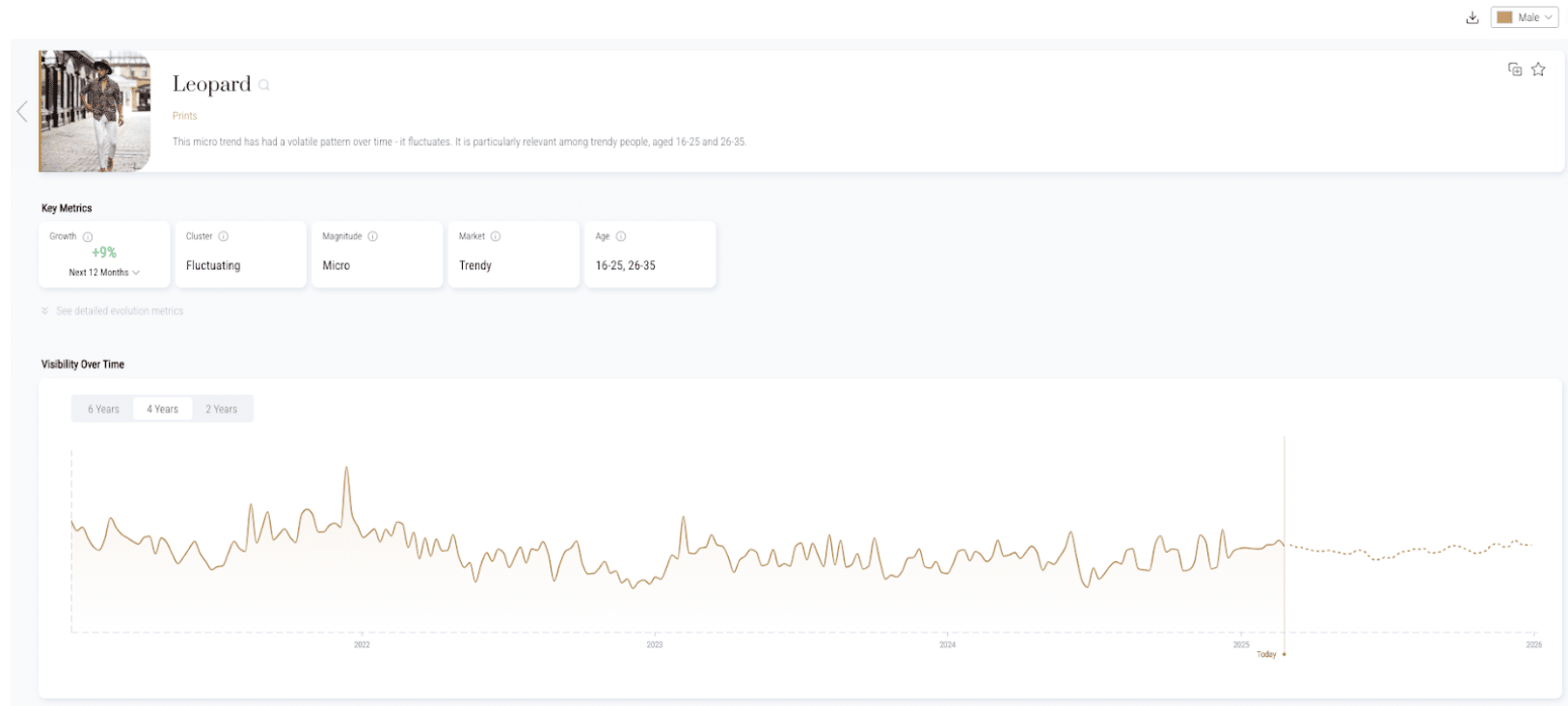

Logic follows, then, that leopard print is forecasted to rise 9% among the men’s Chinese market in 2025. This exchange of masculine and feminine characteristics in clothing is what Beijing-based creative director of Kepler, Jerry Zhang, describes as a positive message for younger dressers: “It's not your gender [that] can distinguish you, but you as a human being with character."

Chinese fashion goes green

Another progressive fashion movement making waves in China today is that of sustainability. The “Go Green” trend in China is being led primarily by domestic designers: for instance, Chinese brand ICICLE uses 100% organic or recycled materials to make its collections.

JNBY, another domestic brand, has put particular focus on linen, a fabric representative of eco-conscious fashion. It comes as no surprise, then, that linen grew in visibility by +26% for women in China in Spring 2024 compared to Spring 2023.

But consumers aren’t only drawn to local brands when it comes to sustainability: Snoozer Loser is an American apparel brand with a store in Shanghai. Their clothing and dyes are hand-made using organic cottons, and they endeavor to upcycle vintage materials in every collection.

Redefining "Made in China"

These new fashion movements in China--from the aforementioned gender-blurring and eco-conscious movements to the unmentioned boom of streetwear--all have one commonality among them: pride. Pride in unbridled expression, in one’s own principles, and finally, in China itself. The term “Made in China” is being subverted from its less-than-flattering connotation to one of national pride for brands and consumers in China today.

Fashion and urban culture journalist and founder of The China Temper, Elsbeth van Paridon, asserts that the “Made in China” label is “undergoing the ultimate 21st century makeover,” and it’s high time. She adds that this movement owes a large part of its success to China’s younger generations, who are “on the prowl for … individual exclusivity, not disposing of their upbringing and heritage.” A report from McKinsey & Co backs her assertions, stating that 90% of young Chinese consumers have a positive perception of local brands.

Building upon a growing sense of national pride, Chinese designers are redefining fashion narratives. Notably, Guo Pei and Samuel Guì Yang have prominently labeled their creations as "Proudly Made in China" since 2014. The traditional cheongsam, or qipao, originating from the Qing Dynasty, is being revitalized by contemporary designers. For instance, Samuel Guì Yang's Spring/Summer 2025 collection showcased modern interpretations of the qipao, blending Chinese and Western aesthetics. Similarly, designers like Feng Chen Wang have infused traditional Chinese elements into their Spring/Summer 2025 collections, presenting them on international platforms such as Paris Fashion Week Men's. These efforts highlight a broader trend of modernizing ancestral designs and bringing them to global audiences.

New digital avenues to Chinese consumer

To call the present the “digital age” feels slightly outmoded, as if the Internet were invented yesterday. However, this time is truly replete with leaps and bounds of technological innovation, especially in the fashion industry. The pandemic has forced brands all around the world to find new ways of reaching consumers and maintaining their creativity and relevance. In China, there has been no shortage of such innovation, as brands have genuinely embraced the challenges set forth. As such, e-commerce, physical retail, and social media have become beacons of hope for fashion brands in China, bringing in more interaction and revenue than could have been predicted at the start of the year.

China's approach to ecommerce

E-commerce in China has always been different to the Western model, with multi-channel, multi-use platforms collecting consumers in one place for maximum efficiency. The pandemic has only proven the cleverness of this model. For instance, ten years ago, Shanghai Fashion Week was just that: a place to show off one’s collection, and to hopefully score clients down the pipe. Today, Chinese e-commerce company Alibaba’s partnership with Shanghai Fashion Week has made virtual shows, livestreaming, and other digital content a reality, and it’s due to these media that designers can now directly sell to customers online if they like what they see. In 2023, Alibaba Group reported significant growth across its platforms:

- Consumer Reach: The company expanded its active consumer base by over 140 million, reaching more than 1 billion active consumers within a year.

- Average Spend: The average Chinese consumer spent approximately $1,320 USD on Alibaba's retail marketplaces.

- Revenue: Annual revenue stood at about $80.6 billion USD, marking a 33.5% increase from 2019.

These figures underscore Alibaba's substantial influence in China's e-commerce and retail sectors, highlighting its role in shaping consumer behavior and driving sales growth.

Pushing the limits of retail in China

In recent years, China's physical retail sector has embraced technological advancements to enhance the shopping experience. Opened in 2020, SKP-S is a collaboration between luxury retailer SKP and South Korean brand Gentle Monster. This avant-garde department store combines high-end designer brands with art installations and advanced robotic displays, creating an immersive environment that blurs the lines between art and fashion.

In 2020, Japanese design studio Nendo revitalized Shanghai Times Square, a commercial building in Pudong, Shanghai. The renovation included the addition of a percolating aluminum screen on the facade, inspired by stage curtains, and reconfiguration of the interior to create a smoother shopping experience.

In 2023, Chinese tech company Cheetah Mobile deployed over 7,000 robots across 1,000 shopping malls in China to enhance shopping efficiency. These robots utilize facial recognition to engage consumers, guide them to stores, collect feedback, and distribute coupons, thereby improving the retail experience.

These developments highlight China's commitment to integrating technology into physical retail, offering consumers innovative and engaging shopping experiences.

Social media: the new language of consumers

In 2019, Gen Z and millennial consumers in China accounted for about 60% of the urban population, with projections indicating a rise to 65% by 2025. These demographics are pivotal to social media engagement, which significantly influences fashion brands and retailers.

For example, Louis Vuitton's "Voyager" fashion show in Shanghai in April 2024 attracted substantial viewership on Chinese social media platforms:

- Weibo: 68 million viewers

- Douyin: 18 million viewers

- Tencent: 8 million viewers

In contrast, the same event garnered only 3.3 million viewers on Instagram and 33,500 on Facebook. Following the show, Louis Vuitton's Shanghai flagship store experienced record-breaking sales, underscoring the substantial impact of social media engagement on consumer behavior. This highlights the critical role of social media in shaping purchasing decisions among younger Chinese consumers, emphasizing the need for fashion brands to leverage these platforms effectively.

In recent years, the influence of Key Opinion Leaders (KOLs) on Chinese consumer behavior has become increasingly significant. Brands, both domestic and international, are leveraging KOLs to enhance their market presence and engage with younger demographics.

BY FAR, a Bulgarian brand, successfully entered the Chinese market by strategically utilizing social media platforms such as Weibo, WeChat, and Little Red Book. The founders collaborated with Chinese fashion influencers, who showcased BY FAR's products, leading to increased brand visibility and consumer interest. A pivotal move was appointing Chinese KOL Grace Chow as the brand ambassador on WeChat, significantly boosting engagement and sales.

Research indicates that Chinese Gen Z and millennial consumers are more responsive to online shopping when KOLs or celebrities are involved. KOLs serve as trusted figures, providing endorsements that influence purchasing decisions. Kelly Tang, a senior analyst at Euromonitor International, notes that Chinese consumers heavily rely on user reviews and recommendations when purchasing luxury goods, with social apps like Little Red Book and Weibo facilitating seamless connections between influencers and consumers.

While younger KOLs have traditionally dominated the scene, there is a growing trend of older KOLs gaining influence. This demographic appeals to a broader audience, including older consumers who value their expertise and experience. Brands targeting this segment are increasingly collaborating with older KOLs to reach a more diverse consumer base.

The strategic use of KOLs has become a cornerstone of marketing strategies in China. Their ability to influence consumer behavior, particularly among younger generations, underscores the importance for brands to engage with these influencers to enhance brand awareness and drive sales.

Fashion events: Propelling Chinese designers onto the global stage

China's fashion events have become pivotal platforms transforming local designers into international fashion innovators. These strategic showcases do more than display collections—they redefine the global perception of Chinese design. Below are some of the most important ones:

- China fashion week (Beijing): With over 100 brands and 170 designers, this event has become a critical launching pad for emerging talent. By attracting global buyers and international media, it provides unprecedented exposure for Chinese designers seeking to break into the global market.

- Shanghai fashion week (SHFW): More than a runway event, SHFW serves as a sophisticated networking ecosystem. It enables designers to connect with international fashion professionals, showcase cultural fusion in design, demonstrate innovative sustainable practices and build direct relationships with global buyers.

- CHIC Shanghai: As China's largest professional fashion trade show, CHIC plays a crucial role in international market entry. It transforms local creativity into global business opportunities, helping designers navigate complex international fashion landscapes.

- Shenzhen fashion week: Focusing on sustainable innovation, this event positions Chinese designers as forward-thinking creatives. By collaborating with organizations like Redress, it highlights eco-friendly design practices and attracts international attention.

Global impact

These events have fundamentally reshaped how the world perceives Chinese fashion design. No longer viewed as manufacturing centers, Chinese designers are now recognized as creative innovators, bringing unique cultural perspectives to the global fashion stage.

The result is a new generation of designers who blend traditional Chinese aesthetics with contemporary global trends, creating a distinctive and compelling fashion narrative that resonates worldwide.

Key designers shaping modern Chinese fashion

Chinese fashion design is experiencing a revolutionary moment, with designers reimagining cultural heritage through a contemporary lens. Heuritech's insights spotlight the innovators transforming the global fashion narrative:

- SHUSHU/TONG: Led by Liushu Lei and Yutong Jiang, this brand anticipates trends like coquette aesthetics, blending hyper-feminine design with cutting-edge sensibilities.

- Xuehu Zhang: A master of surrealist design, Zhang deconstructs fashion through geometric precision and unexpected color interactions, challenging traditional design boundaries.

- Mark Gong: Parsons-trained designer exploring societal narratives through fashion, recently viral for his provocative office-wear reinterpretations that challenge workplace dress codes.

- BUERLANGMA: Qiqi Yuan and Yuanbo Chao's brand pushes avant-garde boundaries with extravagant volumes and bold architectural detailing.

- MARRKNULL: Tom Shi and Mark Wang's label epitomizes the "neo-Chinese style", masterfully integrating traditional elements with asymmetrical, modern silhouettes.

- Sankuanz (Shangguan Zhe): Evolving from eccentric designs to sophisticated techwear, representing the dynamic intersection of Chinese street culture and high fashion.

These designers are not just creating clothing—they're crafting a new global language of fashion that speaks to China's complex, innovative cultural identity.

What is the future of fashion in China?

Chinese consumer sentiment

According to Ipsos’ global consumer confidence index, consumer sentiment around the world is at its lowest at a concerning 41.8 out of 100. But not for Chinese consumers. Ipsos reports that in China, consumer sentiment is at 70.9 out of 100, making it the highest of any country surveyed. The weak consumer sentiment globally is likely due to the pandemic and its many repercussions, but China’s case gets even more strange when one considers that its consumer sentiment is even higher than it was pre-pandemic. So if there were ever an opportune time to make moves in China, it would be now.

For domestic brands, this year has been encouraging. Domestic consumption, government support, and global attention have boosted China’s fashion scene at impressive rates. But luck doesn’t have much to do with it: Chinese brands have succeeded in listening to what their customers want and need throughout this year rife with change.

Where foreign, and often Western, brands tend to push money and advertising once in the Chinese market, domestic brands create highly personalized experiences for their customers. Futuristic shopping experiences, heightened interaction via virtual shopping and social media, co-collaborations between brands and KOLs, and attention to customer desires have made all the difference for Chinese brands. According to Tang from Euromonitor International,

“Chinese consumers are showing an increasing preference for local brands that demonstrate strong capabilities in leveraging new technology and adopting fashionable styles.”

What this means for foreign brands is that it’s no longer sufficient to push Chinese content once in China -- they must incorporate new technologies and trends more wisely into products and brand communication in China.

Finding success in China's fashion market

China is home to a complex fashion industry like anywhere else. Its burgeoning community of consumers are giving rise to a bright fashion future full of inclusivity, interaction, and innovation, from challenging gendered clothing to reinventing the limits of social media. They look to KOLs and their peers for fashion advice, and their favorite brands are those who know how to meet them where they are. They go shopping in boutiques and malls, and they also enjoy the efficiency of multi-channel e-commerce platforms like Alibaba and Taobao.

It is in this way that the possibilities for brands hoping to find a footpath in China’s market are infinite, and with trend forecasting, brands can have even more confidence stepping into the Chinese fashion space. The ability to know which consumers will desire which trends during which season provides brands the opportunity to plan ahead, from collection planning to communication strategizing. Consumers know authenticity when they see it, all that’s left to do is listen.